The long-awaited Autumn Budget has finally been unveiled by Jeremy Hunt.

In the latest round of announcements, the Chancellor has officially notified us that the UK is in a recession.

The Government has notified the following steps as part of the aim of reducing the national debt whilst helping low income households:

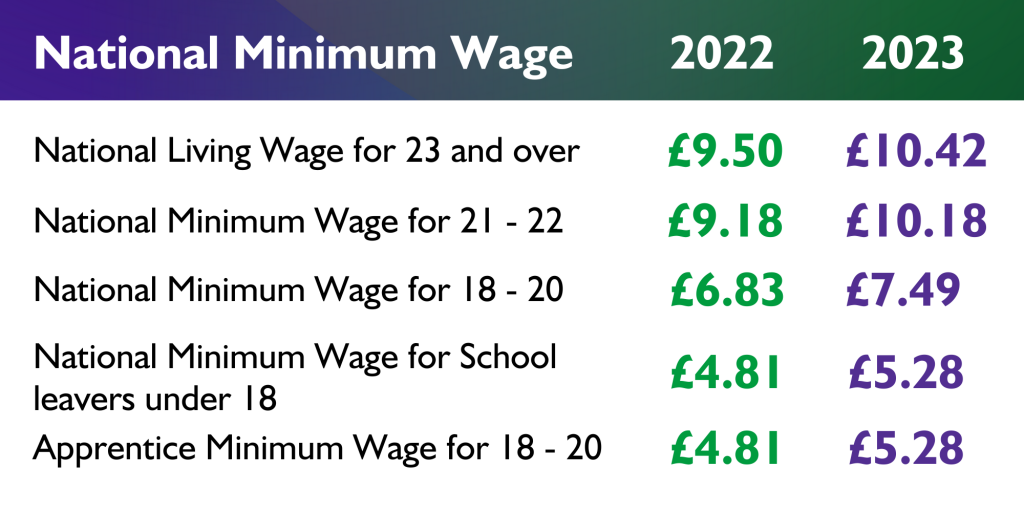

- The National Living Wage will be increased from £9.50 an hour for over-23s to £10.42 from April 2023. This represents an annual pay rise worth over £1,600 to a full time worker.

- The National Minimum Wage rates for younger workers will also increase.

- The dividend tax allowance will be halved. Falling from £2,000 to £1,000 in 2023 and to £500 from 2024.

- Pensions, from April 2023, will rise in line with September’s inflation rate of 10.1%.

- National Insurance, income tax, personal allowance and higher rate thresholds will be frozen for a further two years, until April 2028.

- Freezing tax thresholds for the majority whilst reducing the threshold at which the 45p income tax rate becomes payable from £150,000 to £125,140. Meaning those earning over £150,000 will pay just over £1,200 more in tax every year.

The Chancellor has announced further tax cuts over the next five years, saying: “Nearly two-thirds of properties will not pay a penny more next year and thousands of pubs, restaurants and small high streets shops will benefit.” This has been done in hope of softening the blow for already struggling companies.

If you need further advice around any of these changes from an HR perspective or communicating these key changes to staff, please do get in touch.